It's often said that car subscription marks the birth of car usership after over a century of car ownership. But that's not completely true. After all, car rental consists of using a car for a few days – and it was invented in the 1900s. And car leasing consists of using a car for a few years, and it's been around since the 1930s.

It's often said that car subscription marks the birth of car usership after over a century of car ownership. But that's not completely true. After all, car rental consists of using a car for a few days – and it was invented in the 1900s. And car leasing consists of using a car for a few years, and it's been around since the 1930s.

In both cases, the car is usually provided inclusive of services (maintenance, insurance, tires, etc.) in exchange for a daily (rental) or monthly (leasing) fee. At the end of the agreed period, the customer returns the car to the rental or leasing company and has never owned the vehicle, just used it.

Netflix for cars?

So what's new about car subscription? Basically, it's an open leasing contract for cars, with a limited minimum duration (usually 1 to 12 months) but without a termination date. After the minimum duration, customers can return the car whenever they want. This distinguishes it from leasing contracts, which have a fixed-term duration that is usually between 3 to 4 years.

While car subscription may not represent the invention of “car usership”, could it be for cars what Netflix is for movies and Spotify is for music? Quite possibly, yes. As with Netflix or Spotify, the customer can start and stop their subscription (almost) whenever they want. And that's what makes it different: very easy to access to and with (almost) no commitment. This is precisely the “usage economy” and what a large part of consumers are looking for.

Embracing recurring business

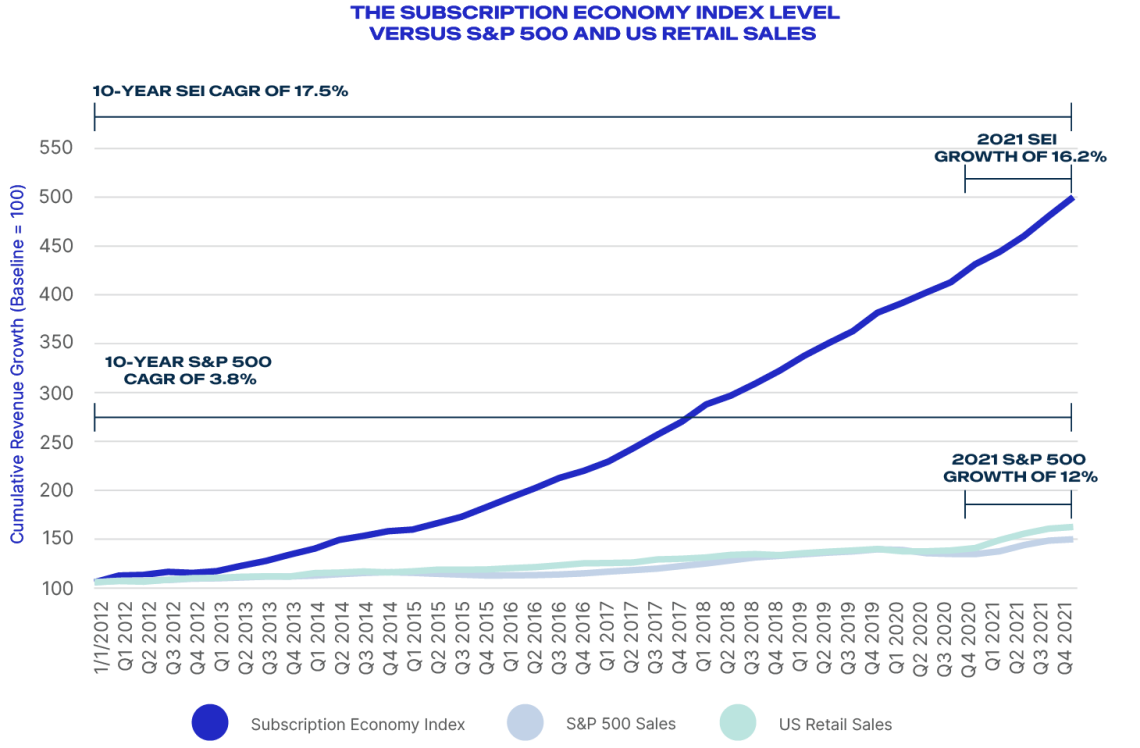

The Subscription Economy Index published by Zuora represents the aggregated performances of a large selection of subscription companies in various domains (SaaS, Media, Manufacturing, Internet of Things (IoT), Business Services, and Communications/Video Conferencing), compared to those of the S&P 500. Here are the results for cumulative revenue growth for the period 2012-2021:

The takeaway is that companies with business models based on subscription outperform the market. What makes this model so powerful? There are several reasons, including the fact that it's a customer-centric rather than a product-centric model. This means subscription companies have the opportunity (or the obligation, if they want to survive) to engage with the customer and build a long-term relationship.

Such customer-centricity pays off. First, it promotes loyalty. If customers are satisfied, they stay with the brand month after month, year after year. This makes their lifetime value much higher because there are no repeated acquisition costs, which tend to be higher than retention costs. Second, the relationship is enduring and not based on a given product, enabling the company to cross-sell other products. In addition, subscription models generate a wealth of data and customer insights, which can then be used to improve the value proposition and strengthen customer satisfaction. Finally, subscription models frequently offer high levels of scalability, allowing companies to reach new customers at reduced costs. All of this is true for subscription models based on movies, music and communication – and it's also true for the automotive industry.

For car producers, owners and sellers, car subscription is a source of new opportunities. It's not a replacement for car sales, but a complement to them, offering the potential to address untapped markets while adopting a recurring business model on top of the classic sell-and-forget one.

A promising future

As a relatively recent phenomenon, car subscription has not (yet) disrupted the industry. It has been associated with numerous successes, but also with certain failures. While forecasts about the growth of the market differ, there is a large positive consensus about the potential of car subscription in the future.

BCG anticipates the market will be worth between $30 billion and $40 billion by 2030 in Europe and the US. Verified Market Search predicts $21.2 billion by 2030 while Straits Research estimates $27.3 billion. Deloitte is bolder with a forecast of €22 billion for 2025 rather than 2030 and in EU alone. Bain & Company doesn't share figures but comments that “although the ultimate size of the subscription services market remains up for debate, it will most likely make up a significant share of car sales in the future. General Motors envisions a share of $25 billion for 2030 for itself alone. And for McKinsey, the subscription-based model could represent about 20% of the total market by 2025.

Finally, private equity also believes in this new model, having already invested close to €2 billion in car subscription startups in equity and debt.

What consumers want

Recent analysis from Loopit reveals that 71% of UK consumers aged 21 to 55 would consider a subscription contract for their next car. And 90% believe “subscription” should be a standard offering, confirming there is an appetite for the market.

But consumer expectations related to car subscription are not always what you might expect. According to a consumer survey from Arval in France and Italy, flexibility is highly-appreciated but price sensitivity remains high. Nine out of 10 people prefer a longer minimum duration (before being allowed to return the car) at a given price rather than a shorter minimum duration with a higher monthly rental.

Other studies from Bain & Company and BCG highlight a number of preconceived ideas that have proven to be false, such as:

- “Consumers only want a new car”: in reality, less than 15% of consumers would only consider subscribing to a new car whereas 85% would be happy with a recently-used car.

- “Regular car swapping is a key feature of car subscription”: only 1 in 4 prospects believes this is important.

New-car subscription helps to widen the segment of potential new-car drivers to include both consumers who have never driven a new car before and those who are younger than regular new-car buyers. And let's not forget B2B customers, a segment that could be strongly attracted by such an offer.

It's also worth mentioning the link between subscription and electric vehicle adoption. Today, many consumers are still hesitant about electric vehicles, and a subscription contract gives them the freedom to test electric mobility for a few months and revert to an ICE car if they so wish. The recent Loopit white paper states that 78% of future electric vehicle adopters in the UK would prefer subscription to outright purchase.

What you need to succeed

Car subscription is about acquiring, servicing and retaining customers while also operating a car fleet. So, what do you need to deliver on these two parts of the service?

The “customer part” of the activity requires features such as a well-known brand, attractive cars, an efficient e-commerce website, a powerful quotation engine, well-positioned prices, strong marketing teams, a robust loyalty program, fast credit-score processes, etc. As an example, the MG Car subscription offering ("MG Auto Abo") in Germany launched in May 2023, powered by Arval:

Much of this is common to any kind of successful online business (few-click online purchase journey, brand awareness, marketing power, etc.). Other elements are more specific to car subscription and require a mastery of cutting-edge technologies (real time quoting, automatic competitive pricing, instant credit score...).

If the “customer part” is about generating revenue, the “car fleet part” is where profitability comes in. And that's especially true for managing the end of the subscription contract. Some business models push for automatically reselling used cars. But reselling must not be the only option. When the customer returns your car, you can decide to sell it if conditions are favorable on the used car market. But you might also decide to keep the car for a second or a third subscription contract. This approach to multi-contract management is essential for building a competitive subscription offer with acceptable minimum durations. To understand why, let's take a closer look at how pricing is defined in leasing.

Why car reuse is crucial

To fix a price in leasing, you usually start from the value of the new car and the contract duration. You then assess the market value of the car at the end of the contract. Basically, the difference between both values divided by the number of months of the contract gives you the monthly linear value of the asset depreciation in the book.

But the market value of a car follows a non-linear curve : depreciation goes very fast when the car is new and slower afterward. As a consequence, for the very same car, if you decrease the contract duration, the monthly value of the asset depreciation goes up and so does the price for the customer. This is the reason why the shorter the leasing contract, the higher the monthly rental, everything being equal.

So, what's different about subscription contracts vs leasing contracts? Unlike leasing, you no longer know the duration of the contract because the customer is allowed to return the car whenever they want after the minimum duration period. You have two parameters to set: minimum duration of the contract and monthly price. If your strategy is to automatically resell the car at market conditions when it's returned, two options can be contemplated:

- You set a long minimum duration, 24 months or more, making prices acceptable to customers. But this product already exists! It's called full-service leasing.

- You opt for a short minimum duration. This means you offer high flexibility but the shorter duration also increases the monthly rental. If you want to propose a contract with a minimum duration of 3 months and you align your pricing with the depreciation of the car, your price will certainly be out of market.

So, how can you propose more flexibility at an acceptable price? By decoupling the subscription “contract duration” (unknown) and the duration you will effectively keep the car, or the “possession duration” (known). Or by decoupling the asset (car) from the contract (leasing, subscription,…). Or, eventually, by considering the car has many lives, instead of just one.

By doing so, you can set the price of your car subscription contract based on your pre-defined “possession duration”, that will be competitive if you choose this period to last 7 years or more. In parallel, you will have the freedom to decide minimum duration period below 12 months. In short: a subscription offering highly flexible and at a good price: the perfect combination for the customer! There's just one thing to bear in mind: you can't resell the car when it comes back after the first subscription period, because the “possession period” is not over. So you have to keep the car, transport it, park it, refurbish it and use it for another subscription contract with a new customer. And so forth until you reach the end of the possession period.

Looks like the magic recipe? It is, as long as you operate your car fleet properly. To do this, you need to account for two extra costs that are generated by reusing the car:

- 1- Logistics: transport, parking, refurbishment.

- 2- Inter-contract idle days, when the car delivers no money because it's not rented, but it continues to depreciate in your book.

To reduce those costs to a minimum, you need a strong software platform, well-oiled processes and efficient fleet management. These are non-negotiable if you want to generate profitability while maintaining affordable pricing.

Reaping the rewards

Car subscription is set to become one of next big trends in the automotive industry. It meets the desire of a large customer segment to have a flexible car-based mobility service without the need to own the car.

The business potential is considerable, with an opportunity for companies to adopt a “subscription” business model with recurring fees. For many “subscription” businesses, the major and sometimes only driver is to attract, please and retain customers. And it's true that, to be part of this market, companies will need to be customer-oriented by offering attractive cars (new or used), developing top class websites, and relying on a strong brand and robust marketing capabilities. But they will also need to do much more to be truly successful.

First, they will have to allocate capital to fund the cars over the period they own them. Then, they will need solid operations, processes and systems to manage the fleet and steer the profitability of the business on a daily basis. Managing these operations will require experience and expertise.

To kick-start such a business, a valuable option is to team up with specialists who can deliver international funding, ensure a website under your brand, and take care of the operations and overall management of your fleet.

The subscription model is certainly not without its challenges, but, if undertaken with the right infrastructure, processes and people, it enables companies to diversify their offer, engage with new business models, and tap into rich opportunities in new customer segments.

Read more